In the financial services industry, there is a growing number of startups and digital banks that quickly navigate market needs. Thanks to Data Room, they win over customers from the market leaders.

Cloud technologies for investment banking

In the banking industry, new technologies are removing barriers to market entry and opening up opportunities for new financial service providers. Competition from startups, internet giants and other industries amid tighter regulation is forcing banks to accelerate digital transformation.

Bank employees from different areas on different continents process sensitive documents together, developers at the car manufacturer work with colleagues at the supplier on new products, partners in a supply chain create joint offers and process sales. Until now, email has been used for this communication in most cases. However, emails are considered neither efficient nor particularly secure – especially when intellectual property is involved. Instead, documents can be exchanged and edited in virtual, specially protected Data Rooms around the globe.

The effectiveness of banking innovations in the work of the bank is manifested not only in the ability to save a certain amount of labor, time, resources, and money but also to gain additional income by increasing the number of customers, resources, which creates conditions for sustainable development and competitive position.

There are two types of investment banks:

- First type. The main occupation is the circulation of securities. They organize the primary and secondary emission of shares and bonds, guarantee their implementation through the repurchase of lots of securities, as well as the provision of loans to buyers.

- Second type. Specialization – long-term and medium-term lending to economic sectors, as well as financing of promising projects.

Data Room alternatives for investment banking

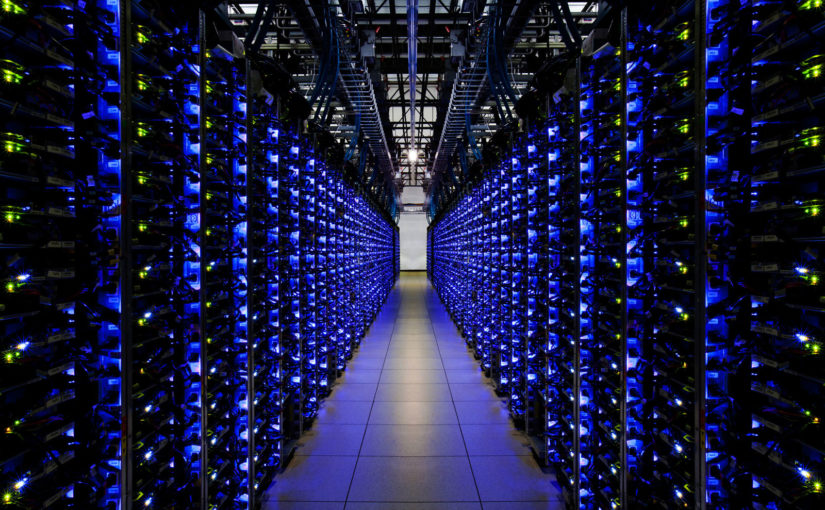

Basic processes, technologies, and organizational structures are needed to redefine customer interactions and develop effective and efficient operating models that foster an open ecosystem of participants. Virtual Data Room is one such structure. Data Room is used to improve security measures and provide a secure workspace for banking transactions.

Nowadays the next-generation customer and back-office systems must be powered by data, analytics, and artificial intelligence (AI) to automate informed decision-making and distribute data, events, and services across the enterprise. All these aspects are provided by the Data Room solution.

Data Room for investment banks perform the following functions:

- assisting enterprises in the issue and sale of securities, underwriting;

- providing guarantees when placing assets;

- intra-balance and off-balance sheet corporate financing – this includes stocks, loans, promissory notes, bonds;

- participation in the reorganization of enterprises – mergers or acquisitions of companies;

- syndicated lending;

- consulting when buying or selling a business;

- market analytics and financial research;

- brokerage services for individual clients and collective funds;

- dealerships with valuable securities;

- management of the portfolio and real assets.

The key point is the concept of digital banking is the implementation of completely end-to-end paperless technologies, without a “digital divide”. Thus, digital banking provides most of its products and services in a digital environment. The bank’s infrastructure is optimized for information interaction in real-time; internal banking culture implies a high rate of change in digital technologies.

The implementation of digital banking via Data Room software gives the bank a reason to reduce the costs of its activities due to:

- a dramatic reduction in the cost of processing operations in the back office;

- reducing the number of errors and failures in programs; decrease in attendance at bank branches and, consequently, staff in them;